As a startup founder, you’re likely juggling a lot, especially when you’re in talks with potential investors. Navigating through due diligence might seem overwhelming amid everything else on your plate. But it’s not just a necessary step; it’s a vital exercise that helps you understand your company’s financial health, viability, and areas needing improvement.

While diving into details and gathering data may not be the most thrilling part of running a startup, it’s crucial. These steps can pave the way for securing substantial investments – often in the millions. Moreover, in today’s competitive investment landscape, being well-prepared sets you apart, showing your dedication to transparency and professionalism.

Today, we’ll cover what investors prioritize in startup due diligence, how startups can get ready for this process, and the essential checklist to ace it. Let’s dive right in!

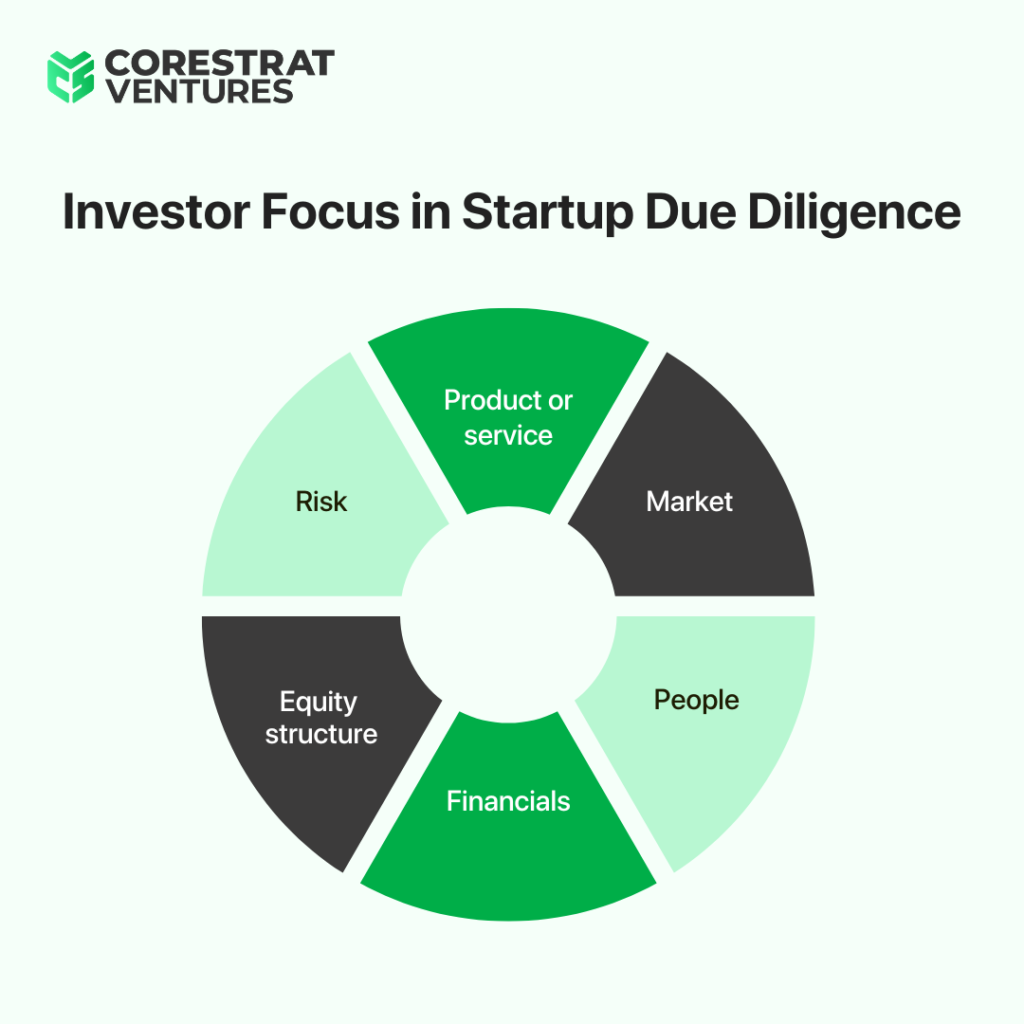

What Are Investors Looking For in Due Diligence?

Investors dive deep into due diligence, examining every facet of a startup’s operations. But that doesn’t mean they sift through every single document a startup has.

Venture capital investors, who often evaluate multiple startups concurrently, know that such a thorough review would be impractical. Instead, they use structured processes that they tailor to each situation. These methods typically focus on specific areas of interest, though there can be some overlap between them.

Here are the key areas on which Investors focus when it comes to due diligence in startups:

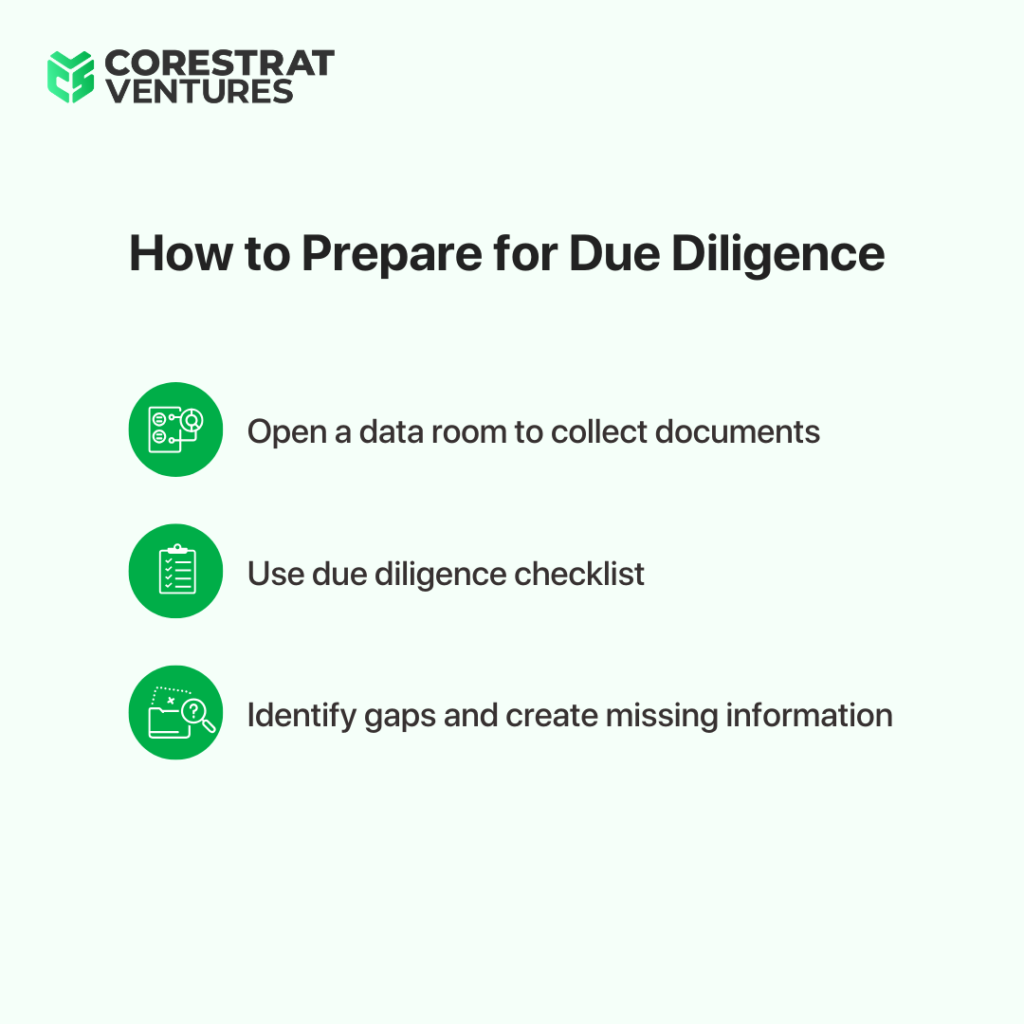

Getting Ready for Due Diligence

A well-prepared startup can gain incredible momentum and be ready to take a leap forward. On the flip side, if your data isn’t organized, investors might hesitate to commit.

Preparation is the key here. By ensuring you have gathered sufficient data on these aspects, you can navigate the due diligence process smoothly and present your startup as an irresistible opportunity for potential investors.

Creating Virtual Data Rooms

Virtual Data Rooms (VDRs) have become the norm for startups to share sensitive information. Often called “deal rooms” or “data rooms,” VDRs offer a safe digital environment for exchanging confidential documents. They serve as secure spaces for storing sensitive information, commonly used in legal proceedings and merger and acquisition deals while facilitating file sharing, document storage, security, and financial activities.

These data rooms are vital for due diligence, a process that can last from weeks to months. A well-structured data room serves as a key asset during this time, enhancing workflows and transparency, which can greatly impact deal success. VDRs are widely used for fundraising, mergers, acquisitions, and various legal transactions involving confidential information.

Data Room Best Practices

Implementing a data room effectively requires following best practices to secure your company’s sensitive information, optimize critical transactions, and build trust with potential investors and partners. Here are some best practices for data room implementation:

Access Management

Not every party needs access to all documents. Use permissions to control visibility based on roles. For example, an HR professional may not require detailed financial records like a CFO does.

Intuitive Organization

Establish a clear hierarchical folder structure with main categories, subfolders, and standardized document names to enhance navigation. Include a master index for guidance and regularly update the structure to meet changing needs, ensuring documents are easily accessible.

Periodic Reviews

Regularly review your data room’s activity log for security and usage monitoring. Keep the data room updated, especially after significant events, as outdated financial statements or contracts can mislead investors or partners.

User Education

Educate users on accessing, navigating, and searching within the data room. Emphasize data security, access permissions, and the importance of confidentiality, along with the consequences of mishandling data. Provide user-friendly training materials and sessions to aid familiarization.

Use Watermarks

For highly sensitive documents, use watermarks to reduce the risk of theft or alteration. Watermarks also discourage unauthorized sharing or information leaks.

Creating a Data Room for Investors: Essential Inclusions

When creating a data room for investors, it’s essential to include crucial financial, legal, and operational documents that offer a thorough overview of your company’s performance and potential risks. Consider adding the following:

- Cap Table

- Pitch Deck

- Business Plans

- Market Analysis

- Corporate Governance Documents

- Legal Contracts (e.g., partnerships, leases, loans)

- Financial Statements (e.g., balance sheets, income statements, cash flow statements)

- Any Additional Information requested in the investor’s due diligence checklist or relevant to the investment decision.

Top Data Room Tools

In today’s market, there’s an abundance of data room tools to choose from, tailored to various needs. Here are some standout options that you won’t want to overlook:

iDeals

iDeals stands out as a leading virtual data room provider, focusing on integrating workflows within a customized environment. With detailed reports and various management tools, iDeals has been successfully utilized by top executives, investment bankers, and lawyers worldwide.

Firmex

Firmex is renowned as the most trusted virtual data room provider, featuring a user-friendly interface that promotes fast and efficient work. Their expert support team is available 24/7, and the platform includes powerful tools designed to protect critical documents and data.

SecureDocs

SecureDocs is recognized as one of the fastest virtual data rooms globally, catering to companies of all sizes. Setting up a VDR takes just 10 minutes at an affordable price. With a strong emphasis on security, SecureDocs implements a high-level security system to safeguard sensitive information.

Encryo

Encryo is a versatile platform that provides email encryption, secure file sharing, and electronic signature collection, allowing businesses to share sensitive data confidently. With 16 layers of security and automated encryption, it protects information while simplifying storage and retrieval through its auto-organization feature.

Onehub

Onehub is a cloud-based file-sharing system and virtual data room (VDR) that streamlines deal management. It provides a secure space for discreet information exchange while allowing team members to stay anonymous. With an easy setup and drag-and-drop feature for uploading multiple files, it enhances usability. The Activity Tracker lets you monitor who accesses your files and track all interactions, ensuring complete visibility and control.

Ansarada

Ansarada is a VDR solution with AI capabilities that effectively manages material event information. Alongside AI-powered data rooms, it offers tools like a deal assistant app, AiQ bidder engagement, and a due diligence Q&A feature. Its interactive assistant provides quick answers to your questions. Additionally, AI insights help assess the likelihood of bidders entering negotiations, enabling you to develop strategies for closing deals and maximizing client value.

BrainLoop

BrainLoop is a SaaS solution designed to protect sensitive data within a company. It offers secure collaboration, M&A support, due diligence, and board communication all in one service. Users can choose between online and offline versions, and the platform is compatible with all mobile devices. Additionally, BrainLoop integrates with MS Office, providing a seamless native working experience.

The Startup Due Diligence Checklist

Now that you’ve pinpointed the crucial aspects of due diligence, it’s time to prepare a checklist to ensure thorough readiness for the review. Here’s a checklist to guide startups as they prepare for due diligence:

1. Financial Information and Business Plan

Investors typically request your business plan and financial records upfront. This includes your balance sheet, income statements, cash flow summaries, ledger, capitalization table, and of course, your business plan itself.

Investors scrutinize these documents to ensure your pitch aligns with your actual financial health. They also look for signs of financial stability and growth potential, as debt can raise concerns about your company’s viability.

2. Intellectual Property Rights

Your intellectual property (IP) rights, like patents, copyrights, trademarks, and design rights, are critical assets that enhance your company’s value. Investors are keen on protecting these assets as they can significantly impact your business’s future sale potential.

It’s advisable to secure patents and trademarks early on to strengthen your position before seeking investment, as lacking IP protections could hinder your funding prospects.

3. Minutes and Business Documentation

Startups often have complex structures due to external investments and multiple co-founders. Investors require detailed ownership structures, up-to-date certificates of incorporation, and documentation from stakeholder and leadership meetings.

Maintaining transparency through thorough documentation ensures potential investors have a clear understanding of your business’s legal standing.

4. Transparency Regarding Lawsuits

If your company is involved in any legal disputes, it’s crucial to disclose this information to investors. Providing documentation on current or pending lawsuits demonstrates transparency and mitigates potential risks associated with legal challenges.

5. Team Interviews and Background Checks

The human element is pivotal in the investment process. Expect potential investors to conduct background checks and possibly interview you and your team members individually. They aim to assess your personalities, values, and skills to gauge your ability to lead and execute.

Preparation involves presenting yourself authentically and effectively under scrutiny, as investors ultimately invest in both your business idea and your team.

6. Supply Chain Contracts and Customer Data

Investors will want assurances that your product or service has market validation. They may request access to customer feedback and verify your relationships with suppliers through your supply chain.

Transparency about your supply chain and customer satisfaction reinforces investor confidence in your operational capabilities and market readiness.

7. Revenue and Sales Numbers

Numbers matter in investment decisions. Investors delve into your revenue streams, examining metrics like churn rate, customer acquisition cost, average revenue per user, conversion rate, and pipeline coverage.

Even if your business is in the early stages, realistic revenue forecasts are crucial. Overly optimistic projections can deter investors who seek grounded financial expectations.

8. Market Analysis

Investors conduct thorough market analysis to assess your product’s market fit and competitive advantage. Understanding industry trends and competitors is vital as investors evaluate your business’s growth potential within the market landscape.

Stay informed about industry trends and market dynamics to demonstrate your market knowledge and strategic preparedness.

This checklist will help startups organize and present essential documents and information effectively during the due diligence process.

Identify Gaps and Create Missing Information

Now that you’ve reviewed the essential documents for due diligence, it’s time to address any gaps that might have slipped through the cracks. This is your opportunity to proactively identify what’s missing before investors spot it.

Take a close look at your checklist and ask yourself: Are there any key pieces of information or documentation that aren’t up to date? This could include everything from financial forecasts to legal agreements. Now is the moment to either dig up those missing documents or create new ones to fill the gaps.

Remember, the goal is to present a complete and compelling picture of your startup, showcasing your readiness and professionalism. Let’s make sure you’re fully prepared for that crucial conversation, and here’s how you can do it:

- Conduct Internal Audits: Start with an internal review of all existing documentation to identify what’s missing or outdated.

- Utilize Templates and Tools: Leverage templates for financial projections, business plans, and other documents. Tools like Google Docs, Notion, or specific startup software can help streamline this process.

- Engage Professionals: Consider hiring accountants, legal experts, or business consultants to help create or review documentation. Their expertise can ensure compliance and accuracy.

- Establish a Documentation Culture: Encourage team members to maintain up-to-date records and share important documents regularly. Set up a centralized repository for easy access.

- Gather Feedback: Before approaching investors, seek feedback from trusted advisors or mentors. They can provide insights on potential gaps and areas for improvement.

After all this, you are well-equipped to tackle the due diligence process and succeed brilliantly! Now, it’s time to pitch to potential investors and secure the funding you need for your dream project. With this comprehensive due diligence guide, it’s all within reach – trust us!

Wrapping up

In conclusion, while tackling due diligence may feel overwhelming amidst the hustle of running a startup and engaging with investors, it’s a crucial step. By carefully preparing and organizing essential documents like financial statements, legal agreements, intellectual property protections, customer contracts, and employee agreements, startups can present themselves as ready and reliable partners. This proactive approach not only builds trust with investors but also paves the way for potential collaborations that drive growth and success in today’s competitive market. Embracing due diligence enhances transparency and professionalism, positioning startups to navigate challenges effectively and seize opportunities for long-term growth and expansion.